Mark Triffitt in Trickle-down theory all washed up now writes that many economists are now arguing that rising inequality leads to reduced economic growth.

Friday, 6 June 2014

Bonham on Optional Senate Preferencing

Dr Kevin Bonham on Optional Senate Preferencing: Not An ALP/Liberal/Green Stitch-Up.

His advance summary:

His advance summary:

1. This article welcomes the recent interim Joint Standing Committee on Electoral Matters report into the Senate voting system and generally supports its recommendations.

2. One important issue in Senate voting reform not yet adequately addressed is the calculation of transfer values for surplus votes.

3. A recent article by Malcolm Mackerras claims that nearly all Senators elected in 2013 were elected by informed voter choice and that major parties are changing the system opportunistically while their vote is falling.

4. However, the Coalition's Senate vote only fell in 2013 because of defects in the current Senate system.

5. At least four and possibly as many as seven Senate outcomes in 2013 did not fairly reflect the will of the voters.

6. The idea that micro-parties combined should be entitled to seats in proportion to their total vote share assumes that micro-party voters very strongly prefer other micro-parties generally to the bigger parties.

7. Analysis of actual Lower House micro-party preference flows shows that any such assumption is false.

Trend vs Variation

A very good YouTube video explaining Trend and variation.

Thursday, 5 June 2014

Labor the party of higher taxes?

Why is the Australian right so keen on ideas that didn't work in the US either?

John Quiggin in Australian right a dumping ground for failed US ideas looks at the Commission of Audit and decides that its ideas are a rehash of work from decades ago or concepts that haven't worked in the US either. He also makes an interesting point:

Second, since revenue is equal to expenditure [2] in the long term, Australians receive from government, on average, the same as they contribute, whether the benefits take the form of cash transfers or publicly provided services. Assuming that total tax payments are proportional to income, and that everyone gets about the same benefit (both of these are pretty good approximations), people receiving more than the arithmetic mean income will mostly be net contributors, and those below will mostly be net recipients. And, since the distribution of income is skewed to the right, the mean is greater than the median, which means that, when everything is taken into account, most people will be net beneficiaries from the tax-expenditure system. The minority of net contributors (that is, high income earners) are of course precisely the people who benefit most from the social order as a whole.

Deficit Levy doesn't do much for Australia's needs long term

Greg Jericho, in Australia needs revenue reform, and tinkering with income tax won’t cut it, shows how little difference the so call deficit levy will make.

Pensions for all cheaper than Superannuation?

In Boost pensions to save on aged costs – no, seriously Michael Pascoe looks at the idea of boosting pensions to save on the cost of aged care.

Amidst all the talk of a budget crisis and the need to raise the pension age and cut welfare costs, it seems an utterly outrageous suggestion that we should instead give the pension to everyone and substantially increase it as well.

It sounds like the raving of some loony socialist determined to bankrupt the nation, but it actually makes hard, conservative economic sense and would save the budget billions. It’s just too bad that the federal government won’t have a bar of it – because the federal government is not the stuff of hard, conservative economics whatever their PR spinners might have you think.

The sting in the tail of the suggestion is that increasing the pension and removing any means test from it would come at the cost of scrapping the many tax breaks given to our superannuation system. It’s a brave, brave soul who would be game to take on the vested interests of a $1.5 trillion industry merely in the name of equity and protecting our longer-term budget outlook. And there really aren’t brave, brave souls in either side of parliament.

Does the Commission of Audit hate Australia?

In The Commission of Audit in a nutshell: ideology over evidence Greg Jericho points out how un-Australian the Commission of Audit's report is.

The Commission of Audit is a rare example of a government attaching itself to a document that appears to hate Australia. Its recommendations start from a premise that the Australia which has become the envy of the world needs to be drastically changed. Notions of equality and fairness which have underpinned our health, education and welfare systems would be replaced with a view that efficiency trumps all.Jericho finishes with:

In the past, sensible heads would have prevailed. Many of the recommendations are similar to those in the 1996 commission of audit. A report John Howard largely ignored, and yet bizarrely Australia was able to continue to grow for another 18 years straight. But this government is too full of those who actually believe in this idiotic ideological view of the world – where “reform” is a synonym for “cut”, and ideology trumps evidence. And for them, the budget is just a first step to achieving it.

The non-conviction politician

Nick Feik in Tony Abbott: an unserious man explores Tony Abbott's lack of political conviction.

Friday, 16 May 2014

Tips for the big race

Sarah Berry in Avoiding gel packs and doing a whole lot of nothing may be the keys to running a better race gets some advice from physiotherapist Jason Smith on running a half marathon.

Can you really ensure that certain tax dollars are only spent on roads?

Marius Benson in The fungible world of federal budgets explains that you can't ensure that certain tax dollars are only spent on certain items (e.g. fuel excise on roads).

Thursday, 15 May 2014

Business may not be a long term winner from this budget

In Corporate Australia wasn’t really the budget winner after all Roy Green, Dean of UTS Business School, doesn't think this budget was very good for business after all:

The 2014 Budget has been variously celebrated and reviled as a “budget for corporate Australia”. But this assessment is based on the premise that corporate tax cuts and infrastructure spending will provide the major source of future growth and competitiveness in the aftermath of the commodity prices boom.

What if this premise is wrong? What if the evidence shows that well targeted government programs to promote science, technology and innovation are a more effective mechanism for creating long-term growth and jobs? In this case, we may be witness to one of the larger public policy mistakes of recent times, with serious implications for the structure and performance of the Australian economy.

For all the cuts in the 2014 budget the Government isn't spending any less

In Abbott's Fiscal Churn, 13 May 2014 Stephen Koukoulas has taken a look at the Abbott Government's first budget and he's not impressed:

The 'tough' decisions in the Abbott government budget are obvious and will have a high impact on those effected, but they do little more than fund a raft of its pet spending projects. The paid parental leave scheme, defence, the Medical Research Future Fund, roads, airports and infrastructure are big ticket items that receive the bulk of the money saved from elsewhere in the budget.

This shows that the rhetoric of the budget crisis and need for fiscal repair was, and still is, without foundation. A truly tough budget would have made the tax hikes greater and the spending cuts would have been made without spending offsets elsewhere. The spending cuts would have been broader.

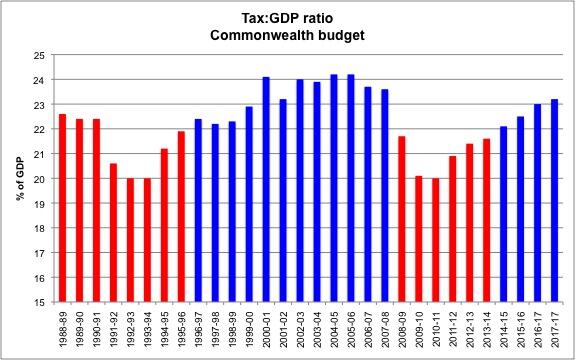

Now to the tax and revenue side.

The budget does confirm that tax and other government revenue will be the driver of smaller deficits.

The budget shows that the tax-to-GDP ratio will rise from 21.4 per cent in 2012-13 to 23.2 per cent in 2017-18. This is a tax take that no Labor government has ever bettered in the 45 years back to 1970-71.

The end point is that this is a budget where the government has squibbed on the decisions needed to return to surplus in a timely fashion.

There have been some tough and inevitably unpopular policy decisions, but they should have yielded a more favourable return to the budget bottom line. Alas, the government has seen fit to use the money saved from these tough policy decisions to pump into other parts of the economy and it has relied on a higher tax take to make a few baby steps along the way to an eventual surplus.

In terms of fiscal consolidation, the first Abbott budget is a very small down payment.

Pink Batts Royal Commission could set dangerous precedents

Jack Waterford writes in Pink batts royal commission could rebound on Abbott:

If ever there was anything with a potential to be an own-goal, it would have to be the Abbott government's decision to establish a royal commission into the home insulation program, and the culpability of politicians and bureaucrats for the deaths of four installers, three by electrocution and one from hyperthermia....

With all of the benefit of hindsight - and one can expect that Hanger, even from 1200 kilometres away, will have plenty of that - we now know that the Commonwealth should never establish any program whatever without surrounding it with great quantities of red tape, rules, regulations, prescriptions, proscriptions, manuals and warnings. Bureaucrats and ministers - even the prime minister - should anticipate, warn against and effectively prevent every imaginable silly thing a builder - or, in due course, any entrepreneurial chancer - could do. Copious warnings should probably be in at least 16 languages, including Pitjantjatjarra.

No doubt it is for just this purpose that Abbott has set up a taskforce to rid the Commonwealth of unnecessary and cumbersome red tape, particularly in areas which are basically state responsibilities anyway.

Some will listen very carefully to statements made, either by counsel for the Commonwealth, or by counsel assisting, which attempt to set any new standard for ministerial responsibility. It will be new ground to have such a standard for work which has been completely contracted out to others, by householders, under regimes which are supposedly under the regulatory and supervisory structures of ''sovereign'' state governments. This could end up being a standard used to hang a future minister - perhaps an Abbott one.

Monday, 12 May 2014

Productivity growth vs average income growth

Via Twitter Matt Cowgill has posted this graph of "Productivity growth and the real average incomes of the bottom 90% in Aus & elsewhere":

I think it shows that over the last 40 years the benefits of productivity growth have not gone to the workers.

I think it shows that over the last 40 years the benefits of productivity growth have not gone to the workers.

We're in deficit because of our previous tax cuts

In We were blinded by bounty, now we must act Ian Verrender writes about the real reason for the Australian Government's budget deficit - the income tax cuts of the preceding decade.

Wednesday, 7 May 2014

Will the Murray Inquiry deliver on Superannuation

In Inquiry's chance to be a super saviour Ian Verrender suggests that the Murray inquiry into the financial system has an opportunity to make our superannuation system more equitable and affordable.

Personally I don't think we should hold our breath.

Personally I don't think we should hold our breath.

Jurors think the judges get it right

Public judgement on sentencing: Final results from the Tasmanian Jury Sentencing Study by Kate Warner, Julia Davis, Maggie Walter, Rebecca Bradfield and Rachel Vermey looks at the reaction jurors to sentences imposed by judges. It's interesting because the jurors generally agreed with the sentences imposed, suggesting the community attitude that sentences are too light is mistaken

To quote the forward:

To quote the forward:

This seminal study, which was funded by the Criminology Research Council, is the first reported study to use jurors in real trials to gauge public opinion about sentences and sentencing. Using jurors is a way of investigating the views of members of the public who are as fully informed of the facts of the case and the background of the offender as the judge. Based upon jurors’ responses from 138 trials, the study found that more than half of the jurors surveyed suggested a more lenient sentence than the trial judge imposed. Moreover, when informed of the sentence, 90 percent of jurors said that the judge’s sentence was (very or fairly) appropriate. In contrast, responses to abstract questions about sentencing levels mirrored the results of representative surveys. The results of the study also suggest that providing information to jurors about crime and sentencing may be helpful in addressing misconceptions in these areas.

Tuesday, 6 May 2014

Don Russell on Canberra, the public service, innovation, etc.

In Reflections on my time in Canberra Dr Don Russell makes some interesting observations about the public service, universities, industry, innovation, the economy and the role of ministers, the Prime Minister and departmental secretaries.

Subscribe to:

Posts (Atom)