Greg Jericho in Is Australia's government debt really as bad as Tony Abbott claims? explains why Australian Government debt is not a cause for concern.

Monday, 9 June 2014

The 1917 French Army mutinies

An interesting article on the mutiny by the French Army in 1917: A History of the First World War in 100 Moments: The Nivelle offensive - when the lambs refused to march to the slaughter.

Sunday, 8 June 2014

Bill Clinton's 2012 DNC speech

Mallary Jean Tenore looks at 10 rhetorical strategies that made Bill Clinton’s DNC speech effective.

Friday, 6 June 2014

Changing false beliefs is hard

Maria Konnikova in I Don’t Want to Be Right writes about research into the difficulties in changing false beliefs. It seems if the belief is lightly held it's easy. However, if the belief is important to the person it's very difficult. In such cases efforts to correct a false belief may actually reinforce them.

Some useful NBN related links

jxeeno blog: NBN: FTTP workflow resumes in mainland states

NBN Co: 6SPT Roll Out Map

Graph showing speed vs distance for different DSL technologies:

FTTC Speed Graph:

Devoted NBN: Service Qualification Tool

myNBN Info: List of FSAMs for 6SPT

NBN Co: Work flow:

Right to Know: Victorian FSAM coverage areas

Right to Know: Western Australian FSAM coverage areas

NBN Co: 6SPT Roll Out Map

Graph showing speed vs distance for different DSL technologies:

FTTC Speed Graph:

Devoted NBN: Service Qualification Tool

myNBN Info: List of FSAMs for 6SPT

NBN Co: Work flow:

Right to Know: Victorian FSAM coverage areas

Right to Know: Western Australian FSAM coverage areas

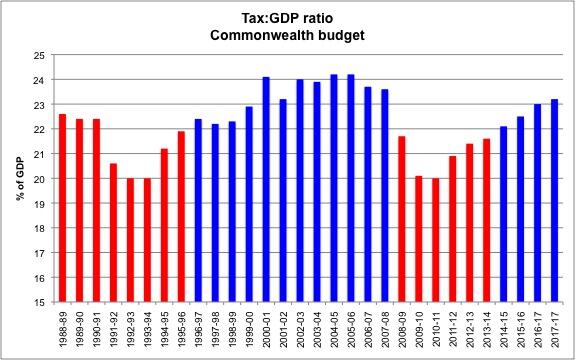

The other way to balance the budget

In Increase taxes to balance the budget, the revenue well is not dry Greg Jericho notes that with increasing government expenditures expected the only way to return to surplus is to increase revenue.

A discussion on revenue and expenditure is well due in Australia, but let us not think the revenue well is dry, or that we have suddenly become a huge spending nation. There are revenue measures around, but increasing taxation is never politically easy – either annoying voters or big business. And it is for this reason that when Hockey suggests everyone will have to share the burden, he talks more about reducing expenditure and ignores raising revenue through tax.

There's been no wages blowout, but maybe a coming wages collapse

Greg Jericho in I'd wager our earnings aren't too high observes that not only haven't we had a wages blowout over the last decade, what we should really be concerned about is a decline in real wages and an increase in inequality over the next decade.

Real wages have not exceeded productivity gains

In Real wages and productivity Matt Cowgill explains why real wages have not grown faster than labour productivity.

It's all due to the rise in the terms of trade. Conversely, as the terms of trade fall we might well see a decline in real wages.

In fact, the notes to Dr Parkinson’s chart say that the real producer wage, ie. the cost to employers of purchasing an hour’s labour, has risen in line with labour productivity.

It's all due to the rise in the terms of trade. Conversely, as the terms of trade fall we might well see a decline in real wages.

Abbott the leader

Jane Gilmore in Leading Abbott looks the contradictions in Tony Abbott and his government. She opens by quoting Tony Abbott on Kevin Rudd:

Too much political thinking is about winning or holding government, rather than about what might be done once you’re there. If our current prime minster had spent more time thinking about how to govern before winning the next election he might have turned out to be as effective a prime minister as he was an opposition leader.She also makes a good point about Abbott as opposition leader:

Tony Abbott on Kevin Rudd, May 2010

The Coalition in opposition was not being led by Tony Abbott. A mob rampaging towards a single goal is not under control of a leader, they just happen be charging in the same direction; but this only becomes apparent when they arrive at their destination, destroy the object of their hatred and then disperse into chaos.

Budget requires blind faith?

Greg Jericho in Coalition banks on blind faith in budget 'fix' wants more evidence than just an assumption that "fixing the budget" will help the economy.

A couple weeks ago the Secretary of the Treasury, Dr Martin Parkinson, delivered a speech in which he talked of our living standards and fiscal sustainability.

However, his focus on living standards was "weak productivity growth, a falling terms of trade, and an ageing population". When he attempted to link our standard of living with the budget he referred to the need to build up our reserves so that should another global recession hit, we could respond similar to how we did in 2008-09.

When he mentioned taxation he talked about the desirability of shifting the dependence from income tax to indirect taxes such as the GST more than about reducing our taxes overall.

In the past, the talk was of budget surpluses over the cycle - that when our economy was performing at trend or above, the government should shift to a surplus. Now the Government has moved to suggesting that shifting to a surplus will see the economy grow above trend.

At present Hockey and Abbott would prefer you just assume their "fixing the budget" will improve the economy without actually having to demonstrate how. Perhaps this is because it removes their need to talk about things like the GST and your blind faith will also make it easier for them to break their election promises.

Do we really want to be like the US?

Warwick Smith in Are we witnessing the emergence of the United States of Australia fears that we are going down to far the US path.

Hockey and Abbott have made their choice. They want us to follow further down the US path. They believe that if you want something, you should pay for it yourself. If you can’t afford it then you don’t deserve to have it because you haven’t worked hard enough or tried hard enough. Their ideology doesn’t recognise the reality; in the kind of society they want us to have if you can’t afford something you probably weren’t born to rich enough parents.

If we consider the wellbeing of all Australians to be important then the Scandinavian model is the clear winner. We can and should increase the proportion of GDP taken in tax and use it to provide the best opportunities to our young people and the best quality of life we can to society’s vulnerable, regardless of where or to whom they were born. This means first class universal education and healthcare and the guarantee of a decent standard of living. If these are not our aims then what is the point of economic progress?

Not all boats rise

Mark Triffitt in Trickle-down theory all washed up now writes that many economists are now arguing that rising inequality leads to reduced economic growth.

Bonham on Optional Senate Preferencing

Dr Kevin Bonham on Optional Senate Preferencing: Not An ALP/Liberal/Green Stitch-Up.

His advance summary:

His advance summary:

1. This article welcomes the recent interim Joint Standing Committee on Electoral Matters report into the Senate voting system and generally supports its recommendations.

2. One important issue in Senate voting reform not yet adequately addressed is the calculation of transfer values for surplus votes.

3. A recent article by Malcolm Mackerras claims that nearly all Senators elected in 2013 were elected by informed voter choice and that major parties are changing the system opportunistically while their vote is falling.

4. However, the Coalition's Senate vote only fell in 2013 because of defects in the current Senate system.

5. At least four and possibly as many as seven Senate outcomes in 2013 did not fairly reflect the will of the voters.

6. The idea that micro-parties combined should be entitled to seats in proportion to their total vote share assumes that micro-party voters very strongly prefer other micro-parties generally to the bigger parties.

7. Analysis of actual Lower House micro-party preference flows shows that any such assumption is false.

Trend vs Variation

A very good YouTube video explaining Trend and variation.

Thursday, 5 June 2014

Labor the party of higher taxes?

Why is the Australian right so keen on ideas that didn't work in the US either?

John Quiggin in Australian right a dumping ground for failed US ideas looks at the Commission of Audit and decides that its ideas are a rehash of work from decades ago or concepts that haven't worked in the US either. He also makes an interesting point:

Second, since revenue is equal to expenditure [2] in the long term, Australians receive from government, on average, the same as they contribute, whether the benefits take the form of cash transfers or publicly provided services. Assuming that total tax payments are proportional to income, and that everyone gets about the same benefit (both of these are pretty good approximations), people receiving more than the arithmetic mean income will mostly be net contributors, and those below will mostly be net recipients. And, since the distribution of income is skewed to the right, the mean is greater than the median, which means that, when everything is taken into account, most people will be net beneficiaries from the tax-expenditure system. The minority of net contributors (that is, high income earners) are of course precisely the people who benefit most from the social order as a whole.

Deficit Levy doesn't do much for Australia's needs long term

Greg Jericho, in Australia needs revenue reform, and tinkering with income tax won’t cut it, shows how little difference the so call deficit levy will make.

Pensions for all cheaper than Superannuation?

In Boost pensions to save on aged costs – no, seriously Michael Pascoe looks at the idea of boosting pensions to save on the cost of aged care.

Amidst all the talk of a budget crisis and the need to raise the pension age and cut welfare costs, it seems an utterly outrageous suggestion that we should instead give the pension to everyone and substantially increase it as well.

It sounds like the raving of some loony socialist determined to bankrupt the nation, but it actually makes hard, conservative economic sense and would save the budget billions. It’s just too bad that the federal government won’t have a bar of it – because the federal government is not the stuff of hard, conservative economics whatever their PR spinners might have you think.

The sting in the tail of the suggestion is that increasing the pension and removing any means test from it would come at the cost of scrapping the many tax breaks given to our superannuation system. It’s a brave, brave soul who would be game to take on the vested interests of a $1.5 trillion industry merely in the name of equity and protecting our longer-term budget outlook. And there really aren’t brave, brave souls in either side of parliament.

Does the Commission of Audit hate Australia?

In The Commission of Audit in a nutshell: ideology over evidence Greg Jericho points out how un-Australian the Commission of Audit's report is.

The Commission of Audit is a rare example of a government attaching itself to a document that appears to hate Australia. Its recommendations start from a premise that the Australia which has become the envy of the world needs to be drastically changed. Notions of equality and fairness which have underpinned our health, education and welfare systems would be replaced with a view that efficiency trumps all.Jericho finishes with:

In the past, sensible heads would have prevailed. Many of the recommendations are similar to those in the 1996 commission of audit. A report John Howard largely ignored, and yet bizarrely Australia was able to continue to grow for another 18 years straight. But this government is too full of those who actually believe in this idiotic ideological view of the world – where “reform” is a synonym for “cut”, and ideology trumps evidence. And for them, the budget is just a first step to achieving it.

The non-conviction politician

Nick Feik in Tony Abbott: an unserious man explores Tony Abbott's lack of political conviction.

Subscribe to:

Posts (Atom)