Australia's largest coalminer, Glencore, paid almost zero tax over the past three years, despite income of $15 billion, as it radically reduced its tax exposure by taking large, unnecessarily expensive loans from its associates overseas.

At up to 9 per cent, the interest rates on these $3.4 billion in loans were double what the company would have had to pay had it simply borrowed the money from the bank.

As it was claiming tax breaks in Australia on these inflated interest payments, the secretive Swiss-based multinational actually increased its lending to other related parties interest free. This may include its executives. Nobody from Glencore, which used to be called Xstrata, was available for comment despite repeated requests.

The aggressive tax avoidance tactics of Glencore Coal International Australia Pty Ltd have been identified in an independent analysis of the company's accounts for Fairfax Media by an expert in multinational financing.

Along with the blatant irregularities in its borrowing and lending, the study also found a hefty increase in Glencore's coal sales to related companies (up from 27 per cent to 46 per cent of total sales, with no explanation), indicative of transfer pricing - also known as profit-shifting - and an activity that appears to breach Section IVA of the Income Tax Assessment Act - the part that deals with schemes designed to comply technically with the law but whose ''dominant purpose'' is really to avoid tax.

Friday, 27 June 2014

Glencore and (no) tax

In Glencore tax bill on $15b income: zip, zilch, zero Michael West reports on an analysis of Glencoe's accounts and the methods it uses to ensure it doesn't pay tax in Australia.

Thursday, 26 June 2014

Tuesday, 24 June 2014

Copyright maths

Rob Reid has a TED talk where he explains copyright maths in The $8 billion iPod.

Sunday, 22 June 2014

Sliding Floor Pullup

In The Move That Will Make You a Pullup Powerhouse Kelsey Cannon shows one way to do a pullup if you don't have a bar, or the strength.

John Hewson has an interesting point on Superannuation

In Tony Abbott choked by lack of vision, not ideology Peter Hartcher interviewed John Hewson about the recent budget and Tony Abbott's performance. He made an interesting point about Superannuation:

What could the government have done to make the budget fairer? “I’m in favour of tightening the eligibility for pensions, but you should increase the pension payment for the people who remain, pay bigger pensions.

“And at the same time you look at pensions you have to look at superannuation tax concessions. It’s heavily skewed in favour of wealthy people.”

To get a $100 benefit from the superannuation system, a person with a modest income of $20,000 a year must put in $118, he says. A person on $250,000 a year must put in only $62.50 to get a $100 benefit.

“That’s a staggering inequity. If you had a more broad-based approach”, dealing with both welfare reform and reform to the generosity of tax concessions for the rich, “you’d have a much more defensible position”.

Saturday, 21 June 2014

Direct Action is really no action

Lenore Taylor in Tony Abbott is no action man on climate change looks at the many problems with the Government's Direct Action policy.

In 2009, Turnbull, still smarting at his demise, wrote: “The fact is that Tony and the people who put him in his job do not want to do anything about climate change. They do not believe in human-caused global warming. As Tony observed on one occasion 'climate change is crap' or if you consider his mentor, (then) senator (Nick) Minchin, the world is not warming, it’s cooling and the climate change issue is part of a vast leftwing conspiracy to de-industrialise the world.”

Turnbull may have been wrong. Abbott may have revised his views since then. But on the basis of the available evidence, not by much. It may indeed be possible to meet credible greenhouse emission reduction targets in an affordable way using policies other than a carbon price. But on the basis of the available evidence, not by using this policy.

Julian Burnside suggests some more humane options on the treatment of asylum seekers

Julian Burnside in Asylum seekers can be managed with cheaper and more humane options presents two options for processing refugees humanely:

- Settlement in the community, after a brief period of detention for health and security checks, in country towns or Tasmania. They would be entitled to work and to social security and Medicare.

- Regional processing in Indonesia. Burnside writes:

Those who are assessed as refugees would be resettled, in Australia or elsewhere, in the order in which they have been accepted as refugees. On assessment, people would be told that they will be resettled safely within (say) two or three months. Provided the process was demonstrably fair, the incentive to get on a boat would disappear instantly.I think both ideas have merit. The Indonesian idea shouldn't see significant numbers of people risking their lives in dangerous boats either.

At present, people assessed by the UNHCR in Indonesia face a wait of 10 or 20 years before they have a prospect of being resettled. During that time, they are not allowed to work, and can’t send their kids to school. No wonder they chance their luck by getting on a boat.

Genuine offshore processing, with a guarantee of swift resettlement, was the means by which the Fraser government managed to bring about 80,000 Vietnamese boat people to Australia in the late 1970s. It worked, but it was crucially different from the manner of offshore processing presently supported by both major parties. In addition, other countries also resettled some of the refugees processed in this way. It is likely that Australians would be more receptive to this approach if they thought other countries were contributing to the effort.

A few more Iraq articles

Why U.S. military involvement will hurt Iraq and increase suicide terrorism by Robert Pape

Gwynne Dyer: Tony Blair talks ISIS and the Middle East

Mulling Iraq options: Begin by telling me which of these groups you want to bomb by Thomas E. Ricks

Uprising brings civil war threat closer to Iraq by Ruth Pollard

Gwynne Dyer: Tony Blair talks ISIS and the Middle East

Mulling Iraq options: Begin by telling me which of these groups you want to bomb by Thomas E. Ricks

Uprising brings civil war threat closer to Iraq by Ruth Pollard

Wednesday, 18 June 2014

Chubb on Power Failure and climate politics in Australia

In Philip Chubb: on culture wars, revenge and the triumph of climate denial Willow Aliento speaks to Philip Chubb about his book Power Failure – the inside story of climate politics under Rudd and Gillard.

Higher minimum wages may be better for the economy

In Australian business gets a good deal from the minimum wage Damian Oliver and John Buchanan show why the minimum wage can be good for business.

These are precisely the factors that the Fair Work Commission takes into account each year in its minimum wage case and they are the reasons why the latest increase is entirely justifiable on economic as well as social grounds. Far from being ashamed or embarrassed by our wage rates, Australians should be proud of our minimum wage and the institution we as a nation have nurtured for over a century.

Jonathan Holmes on the real reason the US invaded Iraq

Jonathan Holmes in Neo-cons's naive dream to liberate Iraq explodes into nightmare writes that the reason for America's invasion of Iraq wasn't oil, it was ideology. It's one of the best articles I have read on why the invasion happened.

It’s easy to see clearly in hindsight. But sometimes it’s worth looking back at what people foresaw. The current crisis in Iraq displays more starkly than ever the wilful blindness of the architects of America’s invasion of Iraq in March 2003....

“When Saddam Hussein and his regime are nothing more than a horrible memory, the United States will remain committed to helping the Iraqi people establish a free, prosperous and peaceful Iraq that can serve as a beacon for the entire region.”

That’s what Paul Wolfowitz, Deputy Secretary of Defence in the Bush Administration, told the Iraqi-American community in Detroit in February 2003.

Wolfowitz was one of the most influential of that group of intellectuals and political activists who had, for 30 years before 2003, urged that America must use its military might to oppose totalitarian dictatorships. They had attracted the label “neo-conservative”. But the title of the Four Corners program I made about them, which was aired just a week before the Iraq war began, was “American Dreamers”.

Paul Wolfowitz’s friend and academic ally, Lebanese-born Shi-ite Fouad Ajami, put it this way: “An idea is attached to this war, there is no doubt about it … it really is about the reform, not only of Iraq but … of the Arab world, an attempt to show the Egyptians and the Saudis and others that there is another way of organising political life.”

This was not mere rhetoric for the masses. The neo-cons believed it. And they had persuaded George W. to share the vision. In late February, he told the neo-cons’ own think tank, the American Enterprise Institute: “A liberated Iraq can show the power of freedom to transform that vital region, by bringing hope and progress into the lives of millions.“

It was a beautiful dream. But to many, even then, it was extraordinarily naive.

The neo-cons, said Kurt Campbell, were not conservative at all: “one of the most powerful contributions that conservatives have made to our understanding of how to conduct foreign policy is not to overestimate consequences, don't be overly optimistic… if necessary be pessimistic… I think there is entirely too much optimism about what are the potential hopeful consequences of a major war in Iraq.”

When dreamers control armies, their dreams can be dangerous. But it tends not to be they who suffer, when the real-life nightmares arrive.

Conspiracies and conspiracy theories

In 9/11, Moon Landing, JFK assassination: conspiracy theories follow a deep pattern Richard Evans looks at conspiracies and conspiracy theories.

A lot remains to be done in researching the history, structure and dynamics of conspiracy theories, their relationship with real conspiracies, and the changes they have undergone through time.

It's easy to be alarmist and suggest they are a threat to democracy and to confidence and trust in democratic political systems, but there have been relatively few times in democratic countries where this has really been the case: the McCarthy period in post-war America, which arguably reduced the possibility of democratic dissent and restricted the range of political opinions it was legitimate to express, could be said to have been one. But the mere proliferation of such theories is surely not a threat in itself. The fact that some people believe that men never landed on the Moon isn't going to undermine the American political system or any other. And the widespread belief among Republicans that President Obama is not American is an expression rather than a cause of the divisions now affecting America's public life and political institutions.

Few people in the end believe that we are ruled by alien lizards in disguise. It's only where conspiracy theories are directed at long-term trends rather than specific incidents or single observable phenomena, as in the case of global warming, that there seems to be no easily obtainable resolution to the clash of opinion; and even here, the overwhelming consensus of scientists and experts is solidly behind the conclusion that global warming is happening and is the product of man-made climate change. The debate goes on, but it's not a case of conspiracy theories threatening democracy, whatever else it might be. By themselves, such theories may reinforce political suspicion and prejudice, but they're not the origin of it.

To learn more about the Conspiracy and Democracy project, visit the website conspiracyanddemocracy.org

Sharri Markson seems to back up Wilson's claim about Nowicki

Richard Farmer on his Political Owl blog has a snip of a Sharri Markson column in The Australian with a tidbit on Bruce Wilson's claim that Harry Nowicki offered him $200,000 for a story. Here's the bit:

Glencore Xstrata and tax avoidance

Michael West in Gushing Glencore converts tax flow into tiny trickle notes how Glencore Xstrata manages to pay virtually no company income tax in Australia on its revenue:

Lo and behold, Glencore had booked cash of almost $15 billion from coal mining in Australia in the past three years and had effectively paid zero tax. They make roughly $5 billion a year from copper, zinc and nickel too, but we'll stick with coal today as it would take another two weeks to dig out the rest of the accounts.

Anyway, the boys from Zug - the Swiss tax haven from which Glencore sprang - did actually pay some tax. They managed to ''leak'', as they say in the trade, just $507 million in income tax, on cash receipts of $30 billion. That's roughly 1.7 per cent leakage in seven years.

Tax is levied on profits, or course, not on sales. Cash is more relevant though, since multinationals engage in the practice of transfer pricing; that is, siphoning profits out of this country, where the corporate tax rate is 30 per cent, into more tax-amenable jurisdictions.

Here they were, drowning in cash - the biggest coal boom in history was in full swing - but what does Glencore do? It borrows billions from its parent and other associates overseas and pays them interest on these loans of $1.4 billion. That's flair for you. Get the money out, and saunter off with a tax deduction on your interest payments to boot.

And that is just profit shifting via a few loans. Of Glencore's $4.3 billion in sales last year, some $1.97 billion worth were made to related parties.

Tuesday, 17 June 2014

Stephen Fry on language pedants

In The Best Response to Grammar Nazis, Ever Hillary Kelly has a YouTube video of Stephen Fry hitting back at grammar pedants.

Devolving environmental approvals is a bad idea

Peter Martin in Don't put Australia's treasures in state hands explains the advantages in allowing states to compete with each other. However, he says, this should not extend to environmental approvals.

By competing, each state strengthens the whole. If an innovation in one state doesn't work, it stays there and doesn't damage the rest. If it does work, it spreads and makes the rest stronger. A paper commissioned by former premier Steve Bracks for the Council for the Australian Federation described Australia as a ship with eight separate watertight compartments: "When a leak is sprung in one compartment, the cargo stowed there may be damaged, but the other compartments remain dry and keep the ship afloat", it said....

But until now no Australian government has seriously countenanced the proposition that the environment was a matter solely for the states. Even the Gillard government, which experimented with devolution in an effort to counter "green tape", gave up after it realised state governments wouldn't impose the same high standards as the Commonwealth.

Now the Abbott government is legislating for what it calls a "one-stop shop". Billed as a "major step forward in the government's commitment to reduce red tape" the law would devolve responsibility for environmental approvals to "the most appropriate level of government".

Abbott and Hunt believe the appropriate level is state government, and if it chooses to delegate, local government, raising the spectre of at least eight "one-stop shops", each with different approval processes and none of them necessarily inclined to protect the national environment.

The immense wealth held in tax havens

Heather Stewart in Wealth doesn't trickle down – it just floods offshore, research reveals looks at a report about the vast wealth hidden away in tax havens.

It seems this hurts poorer countries in particular. In many cases wealth hidden offshore exceeds the value of the debt such a country might have.

Using the BIS's measure of "offshore deposits" – cash held outside the depositor's home country – and scaling it up according to the proportion of their portfolio large investors usually hold in cash, he estimates that between $21tn (£13tn) and $32tn (£20tn) in financial assets has been hidden from the world's tax authorities.

"These estimates reveal a staggering failure," says John Christensen of the Tax Justice Network. "Inequality is much, much worse than official statistics show, but politicians are still relying on trickle-down to transfer wealth to poorer people.

"This new data shows the exact opposite has happened: for three decades extraordinary wealth has been cascading into the offshore accounts of a tiny number of super-rich."

In total, 10 million individuals around the world hold assets offshore, according to Henry's analysis; but almost half of the minimum estimate of $21tn – $9.8tn – is owned by just 92,000 people. And that does not include the non-financial assets – art, yachts, mansions in Kensington – that many of the world's movers and shakers like to use as homes for their immense riches.

It seems this hurts poorer countries in particular. In many cases wealth hidden offshore exceeds the value of the debt such a country might have.

He corroborates his findings by using national accounts to assemble estimates of the cumulative capital flight from more than 130 low- to middle-income countries over almost 40 years, and the returns their wealthy owners are likely to have made from them.

In many cases, , the total worth of these assets far exceeds the value of the overseas debts of the countries they came from.

The struggles of the authorities in Egypt to recover the vast sums hidden abroad by Hosni Mubarak, his family and other cronies during his many years in power have provided a striking recent example of the fact that kleptocratic rulers can use their time to amass immense fortunes while many of their citizens are trapped in poverty.

The world's poorest countries, particularly in sub-Saharan Africa, have fought long and hard in recent years to receive debt forgiveness from the international community; but this research suggests that in many cases, if they had been able to draw their richest citizens into the tax net, they could have avoided being dragged into indebtedness in the first place. Oil-rich Nigeria has seen more than $300bn spirited away since 1970, for example, while Ivory Coast has lost $141bn.

Assuming that super-rich investors earn a relatively modest 3% a year on their $21tn, taxing that vast wall of money at 30% would generate a very useful $189bn a year – more than rich economies spend on aid to the rest of the world.

How wrong was Hayek on Democracy?

William K. Black in Why the Worst Get on Top – in Economics and as CEOs writes that:

Libertarians are profoundly anti-democratic. The folks at Cato that I debate make no bones about their disdain for and fear of democracy. Friedrich von Hayek is so popular among libertarians because of his denial of the legitimacy of democratic government and his claims that it is inherently monstrous and murderous to its own citizens.

Monday, 16 June 2014

Isis secrets exposed

In How an arrest in Iraq revealed Isis's $2bn jihadist network Martin Chulov describes an arrest by Iraqi intelligence that exposed how wealthy Isis is.

Several hours later, the man he had served as a courier and been attempting to protect, Abdulrahman al-Bilawi, lay dead in his hideout near Mosul. From the home of the dead man and the captive, Iraqi forces hoovered up more than 160 computer flash sticks which contained the most detailed information yet known about the terror group.Quite a breach of operational security.

The treasure trove included names and noms de guerre of all foreign fighters, senior leaders and their code words, initials of sources inside ministries and full accounts of the group's finances.

Sunday, 15 June 2014

Why electricity prices are going up as demand falls

Ross Gittins in Why electricity prices continue to shock people explains why electricity costs keep rising as demand drops, which is counter to normal economic theory:

But hang on, is this guy saying the price of electricity has gone up because demand for it has gone down? Isn't it supposed to be the other way round? Isn't a fall in demand supposed to lead to a fall in the price?Read the whole article.

Well, assuming no change in supply, yes it is. So you're right to be to be puzzled. The relationship I've described between price and demand is, as an economist would say, ''perverse''.

But why? Because, as Garnaut explains, we've stuffed up the deregulation of the electricity market. (Moral: as we're being reminded by the plan to ''deregulate'' university fees, if you deregulate or privatise without knowing what you're doing you can make things worse rather than better.)

Before the reform process began, each state had its own, government-owned electricity monopoly, with little trade between the states. From the late 1980s it was decided to break the integrated state monopolies into their component parts - generation, transmission, distribution and retailing - and form one big eastern Australian electricity market with as much competition and as little monopoly as possible.

The power stations were separated into individual businesses - some of which were privatised, particularly in Victoria - and made to compete in a highly sophisticated ''national'' wholesale market for electricity. Garnaut says this has worked well, with competition keeping the wholesale price low in response to the reduced demand.

But transmission (high-voltage power lines) and distribution (local poles and wires to the premises) are natural monopolies. That is, it's not economic to have more than one network. So whether these businesses are publicly or privately owned, the prices they charge have to be regulated to prevent them overcharging.

Trouble is, Garnaut says, we've done this by fixing the maximum rate of return the businesses are allowed to earn on the capital they have invested. Economists have known for 60 years that this always causes problems because it's so hard to pick the right rate of return.

If it's too low it leads to underinvestment in the physical network, causing blackouts. If it's too high, however, it leads to overinvestment in the network at the expense of business and household customers.

But as well, when monopoly businesses that are guaranteed a certain rate of return suffer a loss of demand, the regulator has to allow them to restore their profitability by raising their prices.

We all pay tax

Matt Cowgill in Myths of the moocher class in Australia has an interesting table showing how even those who don't pay tax really do:

Go and read his post. It's worth it.

Go and read his post. It's worth it.

Rising seas levels indicative of climate change

Stuart Clark writes in Apparent pause in global warming blamed on 'lousy' data:

Climate scientists have been arguing for some time that the lack of warming of the sea surface is due to most of the extra heat being taken up by the deep ocean. A better measure, he said, was to look at the average rise in sea levels. The oceans store the vast majority of the climate's heat energy. Increases in this stored energy translate into sea level rises.

"The sea level shows us the engine of global climate not one of the consequences," said Briggs.

In the past 50 years, sea levels indicated that the stored energy had increased by 250 zetajoules, he said. A zetajoule is 1021 joules. For comparison, mankind generates 0.5 zetajoules of energy every year in its power stations.

Since 1993, satellites have measured sea levels rising by an average of 3mm per year. Unlike the surface temperature, this rise continued throughout the supposed pause in global warming.

Welfare costs us $6000 each. Where does it go?

Joe Hockey has claimed:

As Matt says:

This year the Australian government will spend on average over $6,000 on welfare for every man, woman and child in the country.In What do we get for $6000 each on social security? Matt Cowgill shows where that $6000 goes. Here's his graph explaining it:

As Matt says:

Australians pay $6000 each, on average, to provide care to the elderly and veterans, to ensure the unemployed have something to eat, to give people with disability some independence and care. We pay $6000 each to ensure that we live in a civilised place. To me that seems like an extraordinarily good deal.I agree.

Saturday, 14 June 2014

GFC increased suicides

James Gallagher in Recession 'led to 10,000 suicides' reports that:

The economic crisis in Europe and North America led to more than 10,000 extra suicides, according to figures from UK researchers....

He told the BBC: "There's a lot of good evidence showing recessions lead to rising suicides, but what is surprising is this hasn't happened everywhere - Austria, Sweden and Finland.

"It shows policy potentially matters. One of the features of these countries is they invest in schemes that help people return to work, such as training, advice and even subsidised wages.

"There are always hard choices to make in a recession, but for me one of the things government does is provide support and protection for vulnerable groups - these services help people who are bearing the brunt of an economic crisis."

Andy Bell, of the Centre for Mental Health, said: "The study says what we feared for some time: that unemployment, job insecurity and many other factors associated with the recession are associated with poor mental health and suicide.

Monday, 9 June 2014

When freedom matters look to the intellectuals, not the populists

Mark Textor in A confession - even the elites have their place has an interesting column about elites and intellectuals:

Sharing his mood, I said: ''Typical of the elites, they would not understand popular opinion if it fell on their heads.'' I vividly remember how his mood changed. He asked me to cross the room with him to look at some fading pictures on the wall. Three of them were of him and his wife sharing tea and a meal with Pope John Paul II. Another was a photograph of a group of men in what appeared to be a forest glade. I recall he said: ''These men were what you would call elites, Mark. Writers, artists, lawyers, priests, and at this meeting we were risking our lives talking about the resistance. It was these 'intellectuals' that fought the 'populists'. They spent time in prison fighting for the rights of others.'' It was the first time I'd heard that description used with passion in the negative. "Without these people, you would not be here and we would not have a vote.'' Then he told me he was imprisoned for his work as a lawyer and activist.

The thing that struck me about this former associate of the ''elite'' was that he had fought for true democracy, he had earned his stripes. He had done what he'd done for the right reasons. He was, as we say in politics, ''amongst the action''.

Australia's debt is fine

Greg Jericho in Is Australia's government debt really as bad as Tony Abbott claims? explains why Australian Government debt is not a cause for concern.

The 1917 French Army mutinies

An interesting article on the mutiny by the French Army in 1917: A History of the First World War in 100 Moments: The Nivelle offensive - when the lambs refused to march to the slaughter.

Sunday, 8 June 2014

Bill Clinton's 2012 DNC speech

Mallary Jean Tenore looks at 10 rhetorical strategies that made Bill Clinton’s DNC speech effective.

Friday, 6 June 2014

Changing false beliefs is hard

Maria Konnikova in I Don’t Want to Be Right writes about research into the difficulties in changing false beliefs. It seems if the belief is lightly held it's easy. However, if the belief is important to the person it's very difficult. In such cases efforts to correct a false belief may actually reinforce them.

Some useful NBN related links

jxeeno blog: NBN: FTTP workflow resumes in mainland states

NBN Co: 6SPT Roll Out Map

Graph showing speed vs distance for different DSL technologies:

FTTC Speed Graph:

Devoted NBN: Service Qualification Tool

myNBN Info: List of FSAMs for 6SPT

NBN Co: Work flow:

Right to Know: Victorian FSAM coverage areas

Right to Know: Western Australian FSAM coverage areas

NBN Co: 6SPT Roll Out Map

Graph showing speed vs distance for different DSL technologies:

FTTC Speed Graph:

Devoted NBN: Service Qualification Tool

myNBN Info: List of FSAMs for 6SPT

NBN Co: Work flow:

Right to Know: Victorian FSAM coverage areas

Right to Know: Western Australian FSAM coverage areas

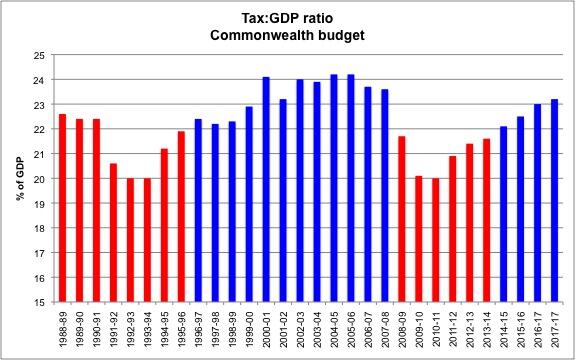

The other way to balance the budget

In Increase taxes to balance the budget, the revenue well is not dry Greg Jericho notes that with increasing government expenditures expected the only way to return to surplus is to increase revenue.

A discussion on revenue and expenditure is well due in Australia, but let us not think the revenue well is dry, or that we have suddenly become a huge spending nation. There are revenue measures around, but increasing taxation is never politically easy – either annoying voters or big business. And it is for this reason that when Hockey suggests everyone will have to share the burden, he talks more about reducing expenditure and ignores raising revenue through tax.

There's been no wages blowout, but maybe a coming wages collapse

Greg Jericho in I'd wager our earnings aren't too high observes that not only haven't we had a wages blowout over the last decade, what we should really be concerned about is a decline in real wages and an increase in inequality over the next decade.

Real wages have not exceeded productivity gains

In Real wages and productivity Matt Cowgill explains why real wages have not grown faster than labour productivity.

It's all due to the rise in the terms of trade. Conversely, as the terms of trade fall we might well see a decline in real wages.

In fact, the notes to Dr Parkinson’s chart say that the real producer wage, ie. the cost to employers of purchasing an hour’s labour, has risen in line with labour productivity.

It's all due to the rise in the terms of trade. Conversely, as the terms of trade fall we might well see a decline in real wages.

Abbott the leader

Jane Gilmore in Leading Abbott looks the contradictions in Tony Abbott and his government. She opens by quoting Tony Abbott on Kevin Rudd:

Too much political thinking is about winning or holding government, rather than about what might be done once you’re there. If our current prime minster had spent more time thinking about how to govern before winning the next election he might have turned out to be as effective a prime minister as he was an opposition leader.She also makes a good point about Abbott as opposition leader:

Tony Abbott on Kevin Rudd, May 2010

The Coalition in opposition was not being led by Tony Abbott. A mob rampaging towards a single goal is not under control of a leader, they just happen be charging in the same direction; but this only becomes apparent when they arrive at their destination, destroy the object of their hatred and then disperse into chaos.

Budget requires blind faith?

Greg Jericho in Coalition banks on blind faith in budget 'fix' wants more evidence than just an assumption that "fixing the budget" will help the economy.

A couple weeks ago the Secretary of the Treasury, Dr Martin Parkinson, delivered a speech in which he talked of our living standards and fiscal sustainability.

However, his focus on living standards was "weak productivity growth, a falling terms of trade, and an ageing population". When he attempted to link our standard of living with the budget he referred to the need to build up our reserves so that should another global recession hit, we could respond similar to how we did in 2008-09.

When he mentioned taxation he talked about the desirability of shifting the dependence from income tax to indirect taxes such as the GST more than about reducing our taxes overall.

In the past, the talk was of budget surpluses over the cycle - that when our economy was performing at trend or above, the government should shift to a surplus. Now the Government has moved to suggesting that shifting to a surplus will see the economy grow above trend.

At present Hockey and Abbott would prefer you just assume their "fixing the budget" will improve the economy without actually having to demonstrate how. Perhaps this is because it removes their need to talk about things like the GST and your blind faith will also make it easier for them to break their election promises.

Do we really want to be like the US?

Warwick Smith in Are we witnessing the emergence of the United States of Australia fears that we are going down to far the US path.

Hockey and Abbott have made their choice. They want us to follow further down the US path. They believe that if you want something, you should pay for it yourself. If you can’t afford it then you don’t deserve to have it because you haven’t worked hard enough or tried hard enough. Their ideology doesn’t recognise the reality; in the kind of society they want us to have if you can’t afford something you probably weren’t born to rich enough parents.

If we consider the wellbeing of all Australians to be important then the Scandinavian model is the clear winner. We can and should increase the proportion of GDP taken in tax and use it to provide the best opportunities to our young people and the best quality of life we can to society’s vulnerable, regardless of where or to whom they were born. This means first class universal education and healthcare and the guarantee of a decent standard of living. If these are not our aims then what is the point of economic progress?

Not all boats rise

Mark Triffitt in Trickle-down theory all washed up now writes that many economists are now arguing that rising inequality leads to reduced economic growth.

Bonham on Optional Senate Preferencing

Dr Kevin Bonham on Optional Senate Preferencing: Not An ALP/Liberal/Green Stitch-Up.

His advance summary:

His advance summary:

1. This article welcomes the recent interim Joint Standing Committee on Electoral Matters report into the Senate voting system and generally supports its recommendations.

2. One important issue in Senate voting reform not yet adequately addressed is the calculation of transfer values for surplus votes.

3. A recent article by Malcolm Mackerras claims that nearly all Senators elected in 2013 were elected by informed voter choice and that major parties are changing the system opportunistically while their vote is falling.

4. However, the Coalition's Senate vote only fell in 2013 because of defects in the current Senate system.

5. At least four and possibly as many as seven Senate outcomes in 2013 did not fairly reflect the will of the voters.

6. The idea that micro-parties combined should be entitled to seats in proportion to their total vote share assumes that micro-party voters very strongly prefer other micro-parties generally to the bigger parties.

7. Analysis of actual Lower House micro-party preference flows shows that any such assumption is false.

Trend vs Variation

A very good YouTube video explaining Trend and variation.

Thursday, 5 June 2014

Labor the party of higher taxes?

Why is the Australian right so keen on ideas that didn't work in the US either?

John Quiggin in Australian right a dumping ground for failed US ideas looks at the Commission of Audit and decides that its ideas are a rehash of work from decades ago or concepts that haven't worked in the US either. He also makes an interesting point:

Second, since revenue is equal to expenditure [2] in the long term, Australians receive from government, on average, the same as they contribute, whether the benefits take the form of cash transfers or publicly provided services. Assuming that total tax payments are proportional to income, and that everyone gets about the same benefit (both of these are pretty good approximations), people receiving more than the arithmetic mean income will mostly be net contributors, and those below will mostly be net recipients. And, since the distribution of income is skewed to the right, the mean is greater than the median, which means that, when everything is taken into account, most people will be net beneficiaries from the tax-expenditure system. The minority of net contributors (that is, high income earners) are of course precisely the people who benefit most from the social order as a whole.

Deficit Levy doesn't do much for Australia's needs long term

Greg Jericho, in Australia needs revenue reform, and tinkering with income tax won’t cut it, shows how little difference the so call deficit levy will make.

Pensions for all cheaper than Superannuation?

In Boost pensions to save on aged costs – no, seriously Michael Pascoe looks at the idea of boosting pensions to save on the cost of aged care.

Amidst all the talk of a budget crisis and the need to raise the pension age and cut welfare costs, it seems an utterly outrageous suggestion that we should instead give the pension to everyone and substantially increase it as well.

It sounds like the raving of some loony socialist determined to bankrupt the nation, but it actually makes hard, conservative economic sense and would save the budget billions. It’s just too bad that the federal government won’t have a bar of it – because the federal government is not the stuff of hard, conservative economics whatever their PR spinners might have you think.

The sting in the tail of the suggestion is that increasing the pension and removing any means test from it would come at the cost of scrapping the many tax breaks given to our superannuation system. It’s a brave, brave soul who would be game to take on the vested interests of a $1.5 trillion industry merely in the name of equity and protecting our longer-term budget outlook. And there really aren’t brave, brave souls in either side of parliament.

Does the Commission of Audit hate Australia?

In The Commission of Audit in a nutshell: ideology over evidence Greg Jericho points out how un-Australian the Commission of Audit's report is.

The Commission of Audit is a rare example of a government attaching itself to a document that appears to hate Australia. Its recommendations start from a premise that the Australia which has become the envy of the world needs to be drastically changed. Notions of equality and fairness which have underpinned our health, education and welfare systems would be replaced with a view that efficiency trumps all.Jericho finishes with:

In the past, sensible heads would have prevailed. Many of the recommendations are similar to those in the 1996 commission of audit. A report John Howard largely ignored, and yet bizarrely Australia was able to continue to grow for another 18 years straight. But this government is too full of those who actually believe in this idiotic ideological view of the world – where “reform” is a synonym for “cut”, and ideology trumps evidence. And for them, the budget is just a first step to achieving it.

The non-conviction politician

Nick Feik in Tony Abbott: an unserious man explores Tony Abbott's lack of political conviction.

Subscribe to:

Posts (Atom)